复盘美股08年崩盘:漫长的头部 不要想着在极端位置入场

本文来自微信公众号“全球宏观投机”,作者熊鹏。

复盘方法论

交易员复盘的目的是扩大自己的交易经验和视野。每个人亲历的经验都非常有限,所以必须有意识去扩充自身经验,以此来准备下一次类似场景。

与研究员复盘区别?研究员侧重在解释为什么,而交易员试图回答我该怎么办。这是一个根本差异,却是很多人不理解,只有少数有经验的交易员可以体会到二者的细微差别。

达里奥已经复盘过2008年的债务危机,我之前在卧虎藏龙的课程上详细讲过2008年股市崩盘时候黄金、美元、日元、国债和股票的不同表现。这次公开发表的这篇文章,我将更加聚焦在美股,将我当前的交易体系带入到2008年的环境。

通过复盘1929,1987和2000年的美股崩盘,我逐步形成了一套固有模式。交易员复盘的最大特点是,带自己的交易体系去复盘,把自己置身于当时巨大的不确定性中,考虑自己的对策,总结前人得失,思考当下应对。

2007年美国经济周期、利率和盈利

经济周期、利率及货币信用条件以及公司盈利状况,是影响股票表现最重要的几个宏观因子。

经济周期是提供资产回报最深层的力量。但是绝大多数人都不知道该如何观察经济周期,最等而下之的就是信仰什么固定期限的经济周期,这种农业时代的周期理论早在1920年代就被扔进了历史的故纸堆,90年后,这种历史遗迹重新流行于东方,这是历史征收的智商税吗?

经济活动是一个永不停滞的连续活动,不同经济部门对就业、产出和消费的影响权重是不同的。我们观察的经济指标,其实是同时发生的,也就是说,从经济的现实看,不存在什么领先和滞后行为,比如企业同时在安排加班和裁员,不同分析者看重的指标不同,绝大部分人被教育或者媒体误导看GDP,就业数据等同步或者滞后指标。而所谓的聪明钱会寻找一些预示经济未来变化的指标,作为观察的重点。

那么,到底哪种观察更加有效呢?这取决于如何定义有效。

我们的定义是:好的经济周期指标是可以预测未来的经济和资产价格变动。

越是强大均衡的经济体,经济周期恶化的前奏就会特别长,因为这种经济体的弹性大,比如建筑行业拖累经济,但能源行业可能还在顺风,这会导致总体经济指标并不差。而且,当代央行和政府对经济干预越来越深,也可能导致经济体在短期表现出区间震荡特征。

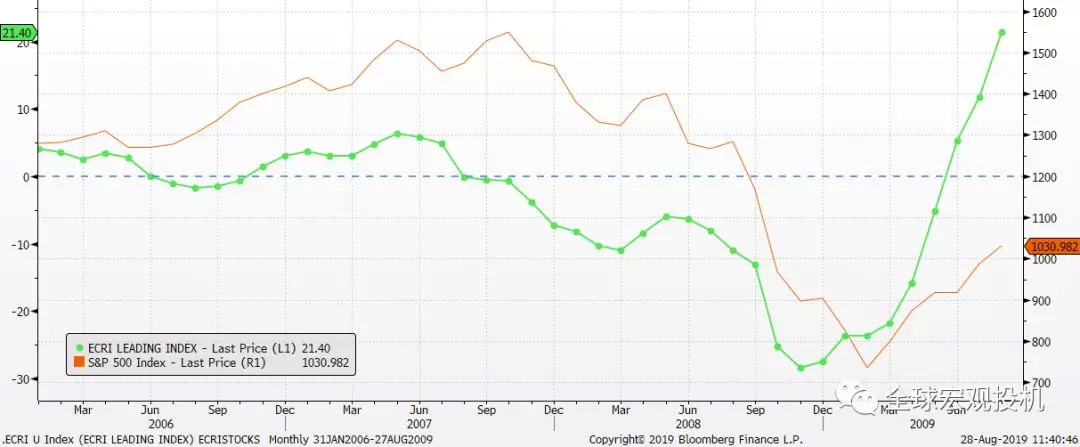

图 美国经济周期与股票周期2006~2008

红线:标普指数

绿线:美国经济周期先行指数

我们在2006年6月发现美国经济已经有下行迹象。股票指数此段时间下跌6.76%。近几年来经济周期指数第一次给出预警。但这个时候经济的同步和滞后指标表现良好,此时包括桥水基金在内,都没有考虑经济衰退的可能性。

2018年2月美股大跌,虽然直接的触发因素是担心债券收益率上升,但当时也恰好是经济周期从高点开始回落。我们发现,聪明钱的一些行动具有高度一致性,因为他们的分析体系有一些共同点。

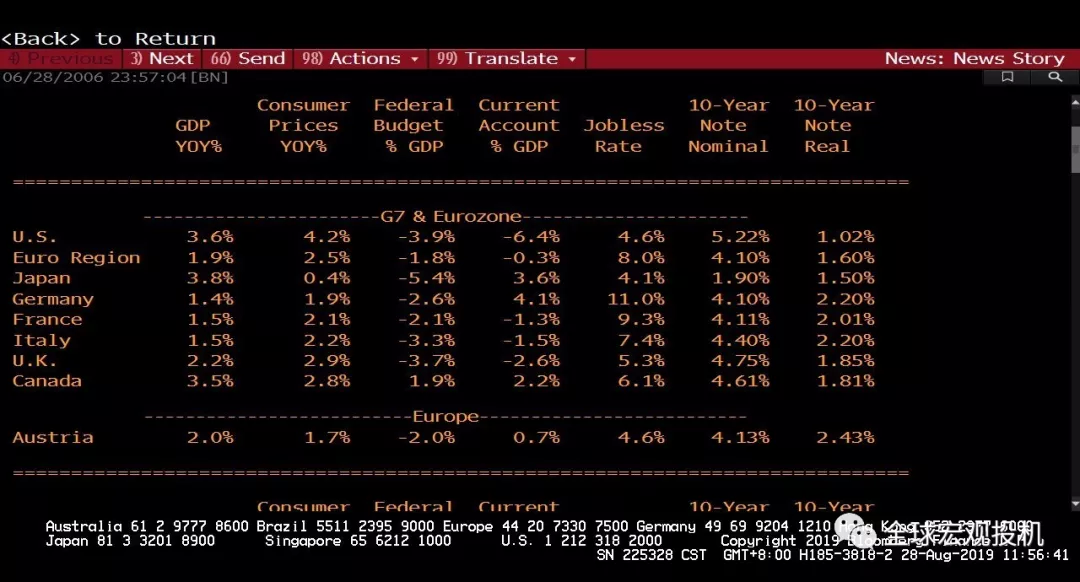

表 2006年6月主要经济指标

从上表中比较有趣的是德国失业率高达11%,而德国经济增长率也低于法国,意大利和英国。我之所以单独将这一点提出,是想提醒读者,每个时代的经济明星都不同,我们不能因为2012年以后德国经济在欧元区的相对表现突出就美化德国。实际上,1990年以后,德国至少有两次被称为“欧洲病夫”。

美联储在2006年5月停止加息,这给股票和经济注入了动力。所以,虽然经济周期有预警,但是不妨碍股票继续上涨很长一段时间。我们现在知道,2007年美股见顶,距离第一次经济周期预警已经是17个月之后。

图 2006~2008年美国利率与通胀

虽然房地产行业开始放缓,但是全球经济景气依然支撑美国经济保持强劲增长,此时真正的问题是通胀,这个问题在全球都比较突出。按照一般的投资经验,通胀引发的加息最终会埋葬股票牛市。我们注意到这轮通胀周期高点是2.5%(核心PCE)。

如果我们从联储停止加息的时点看,联储对于经济的判断是很敏锐的。这是格林斯潘在离任前最后一轮加息。当时的联储主要就是盯住通胀同时希望在通胀前一点采取行动。

跟踪经济周期指标,12月再次转正并且持续走高一直到2007年6月。经济数据经常有比较好的持续性,而同期,股票市场不断创出新高。而通胀这个主要的负面因子,在2006年7月以后开始下行,对于股票而言,这是金发女孩场景。我们注意到,2007年1季度以后,通胀再次开始走高。相对于美联储2%的通胀目标,现在的通胀水平还是太高。但美联储并没有表现出加息的愿望。

仔细理解当时联储的决策逻辑非常重要。格林斯潘最早在2005年8月认为房地产景气即将结束,美联储出于预防停止加息,而通胀也非常配合,在联储停止加息后出现回落。这使得加息的必要性进一步降低。到2006年7月,二手房销售数据创下两年来最低水平,当年二季度抵押贷款止赎率上升。所以,虽然有一定的通胀压力,此时联储更多倾向于支持经济增长,数次暗示降息。

但这一段时间的经济数据好坏参半,包括房地产数据在内,在历经糟糕的2006年以后,2007年3月的新房销售出现强劲反弹。当经济数据超预期时,股票下跌,因为这预示着降息概率下降。这种股票市场反应模式,在2009年以后的全球股票市场成为了一个经典模式。

图 美国新屋和二手房成交量(2003~2008)

那么,投资者最为关心的公司盈利表现如何呢?我使用每日监测的标普公司盈利来观察2007年前后的美股公司盈利,也引用当时的实时新闻来考察。

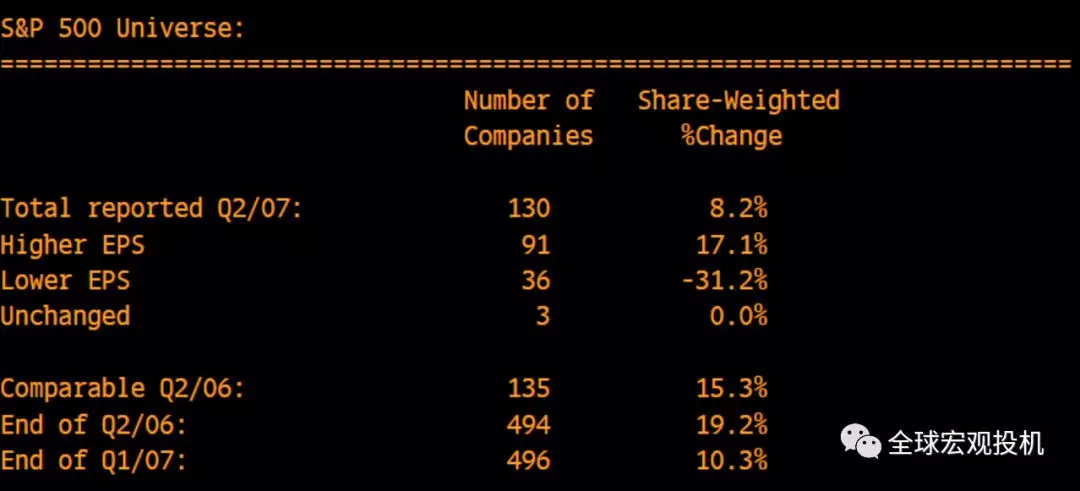

表 美股2007年二季度盈利状况

美股总体盈利增长8.2%,但是相比2006Q2 15.3%的增速已经大幅降低。

图 美股公司盈利监测2006~2008

绿线:标普公司实际盈利同比

蓝线:分析师预期调整

我们看到,美股公司盈利从2006年开始稳步下降。但真正的拐点是2007年9月份以后,即三季报数据同比快速下降,而此时美股到达头部。2008年一季报继续同比大幅下滑,但是股票本身保持稳定。

同时我们看到,分析师调整盈利数据对标普公司盈利有一定的领先性。特别是盈利数据调整变动较大时,2007年7月,分析师开始下调公司盈利预期,而标普三季报的确出现较大下跌。

进入2008年以后,一季度公司盈利大跌后,公司盈利出现快速修复。但现在都限于同比为负的阶段,无论是分析师预期还是报告盈利。在公司盈利负增长阶段,很难再有持续的股票上涨。这点对于2019年的美股启发尤其大。

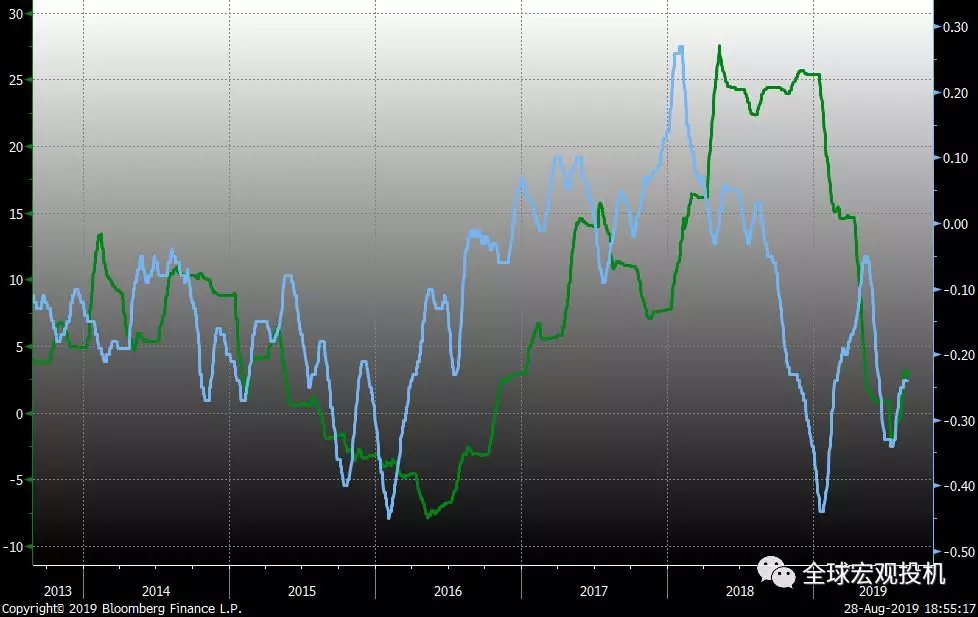

图 公司盈利是美股2019年韧性的最重要来源

我们看到,金融危机后,美国公司仅在2016年一度陷入盈利负增长,特朗普当选后,在减税和中国刺激政策带动下,美股公司盈利保持了大幅上升势头。但进入2019年后,美股公司盈利急速下降,二季度勉强维持了正增长,但分析师预期数据已经显示了三季度标普公司盈利将为负数。要记得2007年10月正好也是美股盈利转负时美股见顶。

漫长的头部

2008年是一个非常经典的美股头部。市场参与者能意识到房地产市场的冲击,但是次贷的规模、影响深度、关联程度直到最后才被市场广泛理解。这与股票杠杆过高,股票上涨过快获利盘太多和股票交易制度不合理(1987年的投资组合保险,2016年初中国股市的熔断制度)引发的股票崩盘不太一样,叠加复杂的经济周期状况、公司盈利和各种救市预期,导致2008年的头部特别漫长。而我们现在几乎就可以下结论,2019年的美股头部同样漫长。

我们也将试着回答一个问题,真的没有人看到2008年的危机吗?

利用WIKI整理出来的事件线,我们很清楚的看到,2005年8月开始,次贷公司、银行、保险公司、投资银行和对冲基金已经开始意识到次贷资产的风险。拉詹在2005年8月就预警CDO(信用违约互换)可能会酿成大祸,格林斯潘、萨默斯都不认可。但格林斯潘也认为房地产周期高潮可能已经过去。

我认为这是一个基本现象,即历史进程的最高明参与者并不是没有意识到问题,而是常常会低估事情的后果。做出低估的来源主要是信息不透明,或者,缺乏历史经验。

首先,我们考察股票到达头部前的两次波动,从这些波动中我们寻找起作用的宏观因子。

其次,我们考察股票到达头部后的下跌以及二次探顶,我们同样希望得知宏观因子的作用。

最后,我们考察见顶后的大幅下挫,特别是雷曼破产引发的市场巨幅震荡,考察那几天的市场情绪是如何崩溃的。

2007.02.22~03.14:第一次自然调整。幅度:6.68%(年化71.67%)

2007年2月22日标普指数创新高。拖累股票的是房地产股票,领涨的是半导体,市场关注的宏观冲击是伊朗核问题,伊朗拒绝了美国的最低铀储量要求。原油上涨到60美元。市场依然关注2006年四季度的公司盈利,这一天标普500指数成分公司的盈利同比增长9.8%。市场没有什么好担心的。但这一天真正的新闻是,汇丰宣布美国的住房抵押贷款业务亏损100亿美元。那么,为什么市场今天的反应平平呢?这是因为2月8日汇丰已经预报过亏损。

2月23日股票下跌。市场情绪在短暂的开年上涨后重新回到房屋抵押贷款问题。应该说,次贷问题,作为一个最重要但是长期的宏观因子,已经开始进入股票定价。这个因子,将来未来一年半,成为美股最重要的宏观因子之一。另外一个重要的宏观因子就是通胀。这个时候,不少交易者都已经看到房贷违约会带来股票市场压力,但是如果这个时候考虑做空,那么会死的很惨(股票后来又上涨了接近10%),这点提醒我们,择时才是做空交易最重要的技巧。

如果回到当下,我们假设贸易冲突产业链重构是市场最大的宏观因子之一,与房贷一样,大家都可以感受到这里面一定有问题,但是短时间又看不到什么问题。包括一些同步的经济数据往往还给出不错的信号(但如果看先行指标就完全不同)。只有极少数清醒的交易者会跟踪市场情绪的细微变化,宏观因子造成的真实压力,直到最后压垮市场。

U.S. Stocks Fall for a Third Day; Treasuries, Oil, Gold Rise

By Nick Baker

Feb. 23 (Bloomberg) -- U.S. stocks dropped for a third day, pushing the Dow Jones Industrial Average to its worst weekly decline since August, as concern mounted that more Americans will default on home loans.

Countrywide Financial Corp., Lehman Brothers Holdings Inc. and Bear Stearns Cos. led financial shares lower, sending the Standard & Poor's 500 Index to its biggest slide in two weeks. Seventy-eight of 88 stocks in an S&P 500 gauge of financial companies fell on speculation loan delinquencies will curb their profit growth.

``Once the ball starts rolling, people don't know where it's going to stop,'' said Michael Alpert, who helps manage about $1 billion at J&W Seligman & Co. in New York. For investors, ``if you have a list of plusses and minuses, the minuses are starting to stack up.''

Stocks retreated this week after a government report showed higher-than-expected price increases, dashing hopes for lower interest rates. Federal Reserve Bank of Dallas President Richard Fisher said today that he remains ``vigilant'' on inflation.

2007年2月27日,全球股票大波动,标普下跌3.5%,巴西股指下跌6.6%,VIX大涨64%。这一天我记忆深刻。中国春节后第一个交易日调控股票市场(打击股票杠杆和查处非法融资),引发股票暴跌,而这个暴跌,迅速传导到全世界。这是我记忆中第一次中国股票引领全球金融市场。

虽然美股市场最近一直担心的是房屋抵押贷款公司,但这一天市场的重点完全转移到中国经济健康上面来。罗杰斯认为中国经济会出现严重问题。

这一天道指出现闪崩,这是程序化交易引发的。这个现象到现在越来越频繁。闪电崩盘看起来是计算机的问题,但极端价格其实往往隐含了很多深刻的内涵,包括后来的英国脱欧中的英镑,2018年日元闪崩,近些年土耳其里拉,2014年的卢布,那些极端价位后来都成为交易上非常重要的心理位置。

金融板块领跌。市场已经担心房地产抵押贷款的问题,但雷曼当天的跌幅完全正常,市场完全没有意识到它的问题。市场担心中国经济减速,会影响美国金融业的前景。

耐用消费品订单数据也是打击市场情绪的重要指标,集中在汽车和建筑设备领域。耐用消费品和中国经济减速是很多投资者担忧的重要内容。

高通和IBM等中国营收占比较大公司跌幅较大。其实从2007年开始,美股已经开始形成一个对中国敏感的板块。美股投资者还是想当然的把中国股票下跌认为是经济的晴雨表,他们完全不了解中国宏观调控的内容包括股票价格指数。我们现在当然很清楚,中国经济的高点要在9个月后才出现。你也可以说股票是经济的晴雨表,但是这里面实际的关联是非常复杂的,我们不能简单看到中国股票下跌就推论中国经济出问题了。

当天市场主要的新闻总结。

The worldwide tumble was sparked by China's plan to clamp down on illegal stock market investments. Chinese stocks slumped the most in a decade, while Europe's Dow Jones Stoxx 600 Index dropped 3 percent and emerging markets sank. Russian shares slid from an all-time high; Brazil's Bovespa Index lost 6.6 percent.

An indicator that measures the rate of expected stock-market swings rose the most ever. The Chicago Board Options Exchange SPX Volatility Index, known as the VIX, surged 64 percent as investors anticipated more risk in owning stocks.

Brokerages extended their losses to a fifth day as a pullback in global equities threatens their earnings prospects, which have already been hurt by an increase in mortgage defaults.

Goldman Sachs Group Inc., the biggest securities firm by market value, declined $18 to $196. Lehman Brothers Holdings Inc., the fourth biggest U.S. securities firm, dropped $3.64 to $74.19, while Morgan Stanley, the No. 2, fell $4.39 to $74.13.

China's stock market drop is a concern because U.S. securities firms have become more reliant on growth in international markets, including Asia. At the same time, the weakening U.S. home loan market will reduce brokers' revenue from underwriting securities backed by mortgages.

``Anything disrupting the free flow of global capital in an increasingly international setting is going to upset investors,'' said Leo Grohowski, who helps oversee $100 billion as chief investment officer at U.S. Trust Corp. in New York.

Durable Goods

The Commerce Department said orders placed with U.S. factories for durable goods slumped 7.8 percent following a 2.8 percent gain in December. Orders excluding transportation equipment slid 3.1 percent.

The figures suggest reluctance among companies to invest has carried into 2007. Bloated stockpiles at auto dealers and construction-equipment makers may restrain production early this year, Federal Reserve Chairman Ben S. Bernanke told Congress this month.

``With some potential signs of cracks, be it China or the durable goods orders, this might be setting us up for a cooling or a pullback in the market,'' said Jason Cooper, who helps manage $2.5 billion at 1st Source Investment Advisors in South Bend, Indiana. ``I'm much more bearish than bullish right now.''

Qualcomm Inc., the world's second-biggest maker of chips that run mobile phones, lost $2.40 to $40.25. Chief Executive Officer Paul Jacobs last year said the company expects a ``huge market'' for advanced devices in China. International Business Machines Corp., which owns about an 11 percent stake in China's Lenovo Group Ltd., dropped $2.95 to $93.96.

影响美股的几个主要因素在这一天的巨幅波动中昭然若揭。房地产抵押贷款是市场主要的担忧,但却不是引发今天市场波动的根源。耐用品订单、中国股票大跌才是引发波动的直接来源。我们可以把耐用品订单归结到房地产周期这个宏观因子里面,而中国则代表全球关联宏观因子,这个宏观因子时不时会冲击美股,到了2011年,欧元区债务危机则成为这个宏观因子的主要内容。

这一天是非常重要的一天,但其实也是误导的一天。市场放大了中国股票大跌对美股的影响。而中国股票的巨幅涨跌,几乎都是政策干预的结果,而国外投资者往往容易将这些价格变动误解为经济基本面信号,这个现象直到今天都还如此。

2007年3月14日美股收出一根下影线,收盘大涨。雷曼宣布次贷风险可控,最大的次贷公司Countrywide大涨,市场认为次级贷款对金融系统冲击有限,标普指数中的16只建筑类股票全部上涨。

市场重心依然是在次级贷款上面,一旦这方面的情绪得到缓和,股票就会恢复上涨,今天预示了2月22日开始的调整结束。

2007年3月21日,标普上涨1.7%。美联储暗示倾向于降息。这是多么熟悉的故事场景,所以,利佛摩尔一直讲,华尔街没有新鲜事。市场开始预期不迟于8月,联储将开始降息周期。

U.S. Stocks Surge on Fed Outlook; Dollar Drops to Two-Year Low

By Eric Martin

March 21 (Bloomberg) – The U.S. stock market posted its biggest gain in eight months, wiping away most of the losses for the year, after the Federal Reserve indicated it is no longer biased toward higher interest rates.

Citigroup Inc. and JPMorgan Chase & Co. sent the Standard & Poor’s 500 Index to its steepest three-day rally in four years on prospects the Fed will lower borrowing costs, spurring loan demand and bolstering profits. Morgan Stanley, the world’s second-biggest securities firm, climbed the most since March 2003 after reporting first-quarter profit surged 70 percent.

``We’ve been waiting for the Fed to be on our side,’’ said Michael Mullaney, who manages $10 billion at Fiduciary Trust Co. in Boston. ``The Fed’s next move is probably going to be a cut, and probably sometime no later than August.’’

2007年7月16日,美股新高。虽然次贷依然是市场讨论的热点,但是今天市场更加关心石油和天然气股票。雷曼的股价也回到了72以上的位置。

2007年7月17日,能源类股票拉低指数,市场认为过高的汽油价格将抑制原油消费。这是一个非常普遍的情况,即市场同时存在很多板块,一个板块的负面情绪开始累积,但往往市场并不是特别大的反应。如果这种负面情绪持续数日,就有可能传染到主要的宏观因子板块。

2007年7月20日,美股下跌1.2%,几天的市场徘徊后重心重回次贷。但是不少基金经理认为美股非常安全,他们的理由是,美股二季度盈利大幅超越预期。我批评过多次华尔街盈利预期的把戏,但是市场就是这样,明知道这是假的,也会开心的上涨。所以,盈利预期这个因子,在现在的美股分析中,已经越来越不重要。

U.S. Stocks Tumble Amid Mortgage Losses; Merrill, Lehman Drop

Speculation that the worst housing slump since 1991 will be exacerbated as defaults by the riskiest borrowers surge prompted the Dow Jones Industrial Average to retreat after closing above 14,000 for the first time on July 19. Caterpillar Inc. fueled the decline after its profit dropped on rising costs and falling U.S.

``Anything having to do with the subprime-mortgage meltdown that's taking place -- and certainly Caterpillar with its construction equipment related to housing falls into that category -- are being taken out and shot,'' said Jeffrey Kleintop, who helps oversee more than $150 billion as chief market strategist at LPL Financial Services in Boston.

`Some Resistance'

Stocks rallied July 19, sending the S&P 500 and Dow to records, following better-than-expected results from International Business Machines Corp., Juniper Networks Inc. and Sherwin-Williams Co.

The market will ``run into some resistance in here because we've had a nice move up,'' said Edward Hemmelgarn, who oversees about $350 million as president of Shaker Investments Inc. in Cleveland.

More than one-quarter of S&P 500 companies have reported second-quarter results, posting an average 8.1 percent profit increase. The compares with the 4.6 percent growth estimate of analysts when the quarter ended, according to a Bloomberg survey.

``Seeing such strong numbers across the board, I think this market still has got legs,'' said Joseph Ranieri, a trader at Canaccord Adams Inc. in Boston.

Next week is the busiest of second-quarter earnings season, with at least 181 companies in the S&P 500 posting results. They include Anheuser-Busch Cos., Apple Inc., AT&T Inc., Exxon Mobil Corp., McDonald's Corp. and Merck & Co.

Investors will get clues on the health of the U.S. economy next week.

2007年7月26日,标普大跌2.3%。市场再次被次贷因子打击。这天艾森美孚石油公司业绩低于预期,市场担心它的融资能力,一些公司的CDS价格大涨。一家1.77亿美元的澳大利亚对冲基金因为次贷投资而暂停赎回。大摩宣布对次贷客户更加严格的限制。

2007年8月3日,标普大跌2.7%。贝尔斯登旗下的两只对冲基金关闭。市场再度担心次贷对金融体系的冲击。

2007年8月6日,金融类股票大涨,房地美大涨10%,两房要求监管层放宽他们持有抵押贷款上限,明天美联储议息会议,市场预期保持5.25%的政策利率不变。

2007年8月7日,美联储保持利率不变但同时安抚市场,我们来看看他们是怎么说的。美联储提出无需恐慌的主要理由是:次贷风险可控,就业状况良好,收入继续提高,全球经济高速增长。

这是不是很熟悉的论调?我们仔细看美联储的理由,发现他跟踪的都是同步指标,同时,他们缺乏对金融市场流动性丧失的深刻理解,而这种理解,往往只有最杰出的交易员才有的经验。

U.S. Stocks Rise on Fed Economy Outlook; Treasuries Decline

By Michael Patterson

Aug. 7 (Bloomberg) -- Energy, financial and utility shares rose on the Federal Reserve's bullish economic outlook, helping the Standard & Poor's 500 Index post its best two-day gain since 2003.

``The Fed's saying there's no reason to panic,'' said Robert Carey, who oversees $31 billion as chief investment officer of First Trust Portfolios LP in Lisle, Illinois. ``They know things are getting tough out there in some parts of the economy but overall we have employment growth, rising incomes and a robust global economy.''

U.S. shares have recouped about one quarter of the $1.6 trillion wiped out since July 13 by concern loans to risky home buyers will spread through credit markets. Ratings provider Moody's Investors Service said earlier that the fallout from subprime-mortgage losses will be ``manageable.''

2007年8月9日,美股没有在联储的鼓励下继续上行,标普大跌3%,这是2月27日以来的最大跌幅。原本以为市场会借势大涨,这是非常经典的一个反应。

这一天是非常值得反复体会的。技术图形上,连续三天大涨后的大跌意味着反弹失败。这是两个宏观因子的对决,即货币条件因子和次贷因子,但最终次贷因子占了上风,市场继续沿着最小阻力线下跌。

2007年8月16日,市场传出贝尔斯登救助的消息,股票在创出新低后强势反弹,技术上形成一个完美的多头信号。另一家次贷公司Countrywide也避免了破产。

U.S. Stocks Climb, Led by Banks; S&P 500 Recovers From Drop

By Lynn Thomasson

Aug. 16 (Bloomberg) -- U.S. stocks rose after a closing rally in banks and securities firms helped restore about $369 billion to the Standard & Poor's 500 Index and $105 billion to the Dow Jones Industrial Average.

Bear Stearns Cos., the second-largest U.S. underwriter of mortgage bonds, climbed the most since 1998 on speculation it may get an infusion of capital. Citigroup Inc., Bank of America Corp. and JPMorgan Chase & Co., the three biggest U.S. banks, provided the best gains in a week for financial shares on expectations the Federal Reserve may lower interest rates this year.

``There are rumors around that there is rescue financing coming in for some of the financials, particularly for Bear Stearns,'' Barton Biggs, a former Morgan Stanley strategist who now runs the $1.5 billion hedge fund Traxis Partners LLC, said in an interview.

从7月16到8月16这一个月,可以说是血雨腥风。标普累积下跌12%。市场异常动荡。起因是没有什么特别起因,能源板块股票走弱,拖累大盘,而悲观情绪很容易进入市场,从而完成向次贷因子的切换,虽然中间有美联储口头安慰市场,市场大幅反弹三天,但是美联储毕竟没有降息,市场再度悲观,直到最后,传出救助贝尔斯登的消息后,这一波调整到底。这也是2007年美股见顶前最后一次技术调整。

这一段时间,伦敦的美元借贷市场利率飙升,花旗银行寻求央行贷款、北岩银行寻求央行帮助,非农数据第一次出现工作岗位净减少(9月7日)都对市场有或大或小的冲击,但是都没有形成较大和持续的价格运动。

伯兰克在事后回忆中,也是将2007年8月15日算作“危机”的起点,他取消了夏日度假。而此刻,距离巴里做空次贷已经有一年多,这个月,他正在认真考虑平仓了。

这个例子再一次说明,的确有人预测到次贷危机并且采取了行动。但是,这个世界并不了解和尊重这样的人。如果不是刘易斯将这些人的故事记录下来,他们很可能又成为历史进程中没有记录的人,他们观察世界的角度,采取行动的勇气,也不会被记录下来。

2007年8月17日,美联储终于表态要支持信贷市场,标普大涨2.5%。

U.S. Stocks Rally; S&P 500 Rises Most in 4 Years on Fed Action

By Lynn Thomasson

``It's just a brilliant move in letting the markets know where liquidity can be found and at what cost,'' said Tim Hartzell, who helps manage about $2 billion as chief market strategist at Kanaly Trust Co. in Houston. ``It brings the banks back to the table.''

``Financial market conditions have deteriorated, and tighter credit conditions and increased uncertainty have the potential to restrain economic growth going forward,'' the Federal Open Market Committee said in a statement following an unscheduled meeting. ``The downside risks have increased appreciably.''

从美联储的声明和市场参与者的评论,我们看到,大家担心的信贷条件恶化伤害美国经济。其实也意味着,当时大家还远远没有弄清楚次贷对金融体系的冲击到底有多大。

2007年9月18日,股票大涨2.9%,VIX当天跌幅23%,美联储降息50个基点,极大震撼了市场。当天很多基金经理认为美国经济衰退的可能性已经大幅降低,次贷危害已经被有力控制。当天也有不同的声音。一是降息后美股防御性的股票表现更好,二是降息后美国将进入经济衰退,罗杰斯一如既往的夸大其词。交易员们预期美国将在下个月第二次降息。

这就是现代市场环境更加复杂的一个证明。现在市场一个重要参与者就是央行。央行可以在短时间内极大干预市场,而市场参与者也往往容易被短期涨跌所迷惑。如何才能真正看到一个中期的趋势?如何在交易仓位中应对短期的巨幅波动?

但是罗杰斯讲的一句话我完全赞同,那就是联储的干预有时候反而是放大了市场风险。央行介入,混淆了真实信号,分散了交易者注意力,虽然短暂让交易者认为次贷问题并不严重,但是这样会为次贷伤害金融体系创造了更多时间。

联储这样做,最根本的原因还是没有认识到问题到底有多严重,根据一般的银行风控模型,违约率并不高,对于夹层融资放大的杠杆,以及这个产品在金融体系内部的传染性,认知都不足。所以联储认为降息50个基点就足以对付次贷违约,激发经济体的信心。

不过我们换个角度,如果联储当时确切掌握了影子银行的规模和对金融体系的冲击,它会采取什么手段呢?

U.S. Stocks Gain After Fed Cuts Benchmark Rate by Half Point

By Lynn Thomasson

Sept. 18 (Bloomberg) -- U.S. stocks rallied the most in four years after the Federal Reserve cut its benchmark lending rate by half a percentage point to keep credit-market losses and the real estate slump from dragging down the economy.

The half-point reduction in the federal funds rate to 4.75 percent was larger than most economists surveyed by Bloomberg predicted. Policy makers pledged to act as needed to prevent losses from mortgage defaults from weakening the broader economy.

``Developments in financial markets since the committee's last regular meeting have increased the uncertainty surrounding the economic outlook,'' Fed policy makers said. ``The tightening of credit conditions has the potential to intensify the housing correction, and to restrain economic growth more generally.''

Vix Drops

The Chicago Board Options Exchange Volatility Index, or VIX, fell the most since June 2006, declining 23 percent to 20.35. The index, which is known as a ``fear gauge'' because it tends to decrease when stocks rise, has fallen 34 percent since reaching a four-year high on Aug. 16.

``Fewer people are betting that the market's going down or that the credit crunch and subprime woes would cause a recession,'' said Nick Raich, director of research at National City Private Client Group, which oversees $34 billion in Cleveland, Ohio.

Five out of six times since 1974 when the Fed started cutting rates, U.S. consumer staples and health-care companies beat the S&P 500 in the following 12 months, according to Ned Davis Research, a Venice, Florida-based firm which has more than 1,000 institutional clients. The two groups rose an average 21 percent, exceeding the index's 14 percent climb and had the ``most consistent'' gains, according to the firm.

Those groups posted the two smallest gains the S&P 500 today. A gauge of consumer staples stocks increased 1.8 percent, while a group of health-care stocks rose 1.9 percent.

`Makes the Situation Worse'

Some investors said a half-point cut might fuel inflation and be perceived as giving into pressure from speculators.

``Every time the Fed turns around to save its friends on Wall Street, it makes the situation worse,'' Jim Rogers, the 64-year-old chairman of Beeland Interests Inc., said in an interview from Shanghai before the Fed announcement. ``If Bernanke starts running those printing presses even faster than he's doing already, yes we are going to have a serious recession. The dollar's going to collapse, the bond market's going to collapse.''

Traders boosted bets that the Fed will lower the benchmark interest rate a second time at the Oct. 31 meeting, according to federal funds futures contracts. The futures show a 69 percent chance of a 0.25 percentage point cut from 4.75 percent to 4.50 percent, up from 38 percent odds yesterday.

超预期降息和下一次降息预期支撑美股从9月18日持续上涨到2007年10月11日,这一天,美股创新高。这是在次贷已经开始侵蚀美国金融体系和实体经济背景下。我们现在,习惯将其称之为美股的“韧性”。

2007年10月11日,美股见顶。这天市场担心的是谷歌公司估值太高。市场已经有一段时间不太把次贷作为主要的宏观因子了。

我们几乎可以确定的说,不会有人在这一天认真做空美股。这个示例再一次说明,无论做多还是做空,都不要想着在极端位置入场。

2007年10月19日,股票大跌2.6%。这一天一个主要的触发因素是标普500成分股三季报盈利自2002年以来第一次转负,金融行业领跌。之前的15到17号,美国陆续出台了一些救市措施,主要针对无法偿还贷款的公司和个人,但是市场并没有就此作出积极反应。这是一个非常重要的经验:

看似宏观因子预期变好的信息冲击后,市场没能作出应该有的反应,说明这个利好的力度是不够的。甚至有时候,这种消息适得其反,反而推动价格反方向运动。

公司盈利数据打击中,金融股票领跌,这是对主导市场情绪宏观因子的一种自然反应。

10月22日,中国中信证券参股贝尔斯登,双方决定成立合资公司,中信注入10亿美元,美股反弹。

10月24日,美林发布其93年历史上最大亏损,市场大幅下跌,但收盘时收回跌幅,市场预期下个礼拜,美联储将再次降息50个基点。今天除了金融股大跌,技术股也大跌,原因同样是业绩不及预期。一些经验老道的投资者认为业绩冲击将会成为常态,主要是金融行业的坏账。也有基金经理对美股的迭创新高表示非常不解。这一天最有意思的是,收盘上涨。当日收盘图形是锤子形态,多头力量依然非常强大。

这一天的新闻非常值得反复体会。

U.S. Stocks Decline; Merrill Lynch, Broadcom, Amazon.com Fall

By Lynn Thomasson

Oct. 24 (Bloomberg) -- U.S. stocks dropped for the first time in three days after Merrill Lynch & Co. reported the biggest quarterly loss in its 93-year history and home sales tumbled.

Merrill fell the most since 2002 on $8.4 billion in writedowns from credit-market losses. Broadcom Corp., the maker of chips for Nintendo Co.'s Wii game console, posted its steepest decline in five years after earnings decreased on higher research costs. A profit forecast that may miss some analysts' estimates sent Amazon.com Inc. to its biggest slide in 15 months.

Today was ``very symbolic of what's going to trouble the market,'' said Leo Grohowski, who oversees $162 billion as New York-based chief investment officer at Bank of New York Mellon Wealth Management. ``We may see more pain before we see gain.''

Writedowns sparked by the worst housing slump in 16 years have caused third-quarter profits to decline by an average 25 percent for financial companies in the S&P 500, the poorest performance among 10 industries, according to Bloomberg data. Makers of computer chips have posted an average earnings drop of 2.6 percent on concern consumer spending will decrease amid a slowing economy.

``I have a hard time understanding how the stock market is going to gain any traction given the continued turmoil in the financial stocks,'' said Tom Wirth, who manages $1.8 billion as senior investment officer at Chemung Canal Trust in Elmira, New York. ``We're going to see continued writeoffs in the next 12 months.''

Lower-than-expected earnings from other financial companies, including Legg Mason Inc. and Moody's Corp., pushed a group of banks, brokerages and real estate companies in the S&P 500 to a 0.8 percent drop.

Fed funds futures traded on the Chicago Board of Trade show an 86 percent chance the Fed will lower rates by a quarter-percentage point to 4.5 percent, and 14 percent odds of a cut to 4.25 percent. The contracts yesterday showed traders saw no chance of a half-percentage point reduction by Oct. 31.

``The current rumor on the street is that the Fed is about to convene a special meeting and cut the Federal funds rate another 50 basis points,'' Punk Ziegel & Co. analyst Richard Bove wrote in a note to clients. Fed spokesman David Skidmore declined to comment on the speculation.

Technology Slump

Technology shares retreated 1.1 percent as a group and made up half of the 10 biggest decliners in the S&P 500.

Broadcom plunged $7.14, or 17 percent, to $34.92, the biggest percentage decline since May 2002. The chipmaker said yesterday third-quarter profit fell 75 percent after an expansion into the mobile-phone market boosted research spending. Deutsche Bank Securities cut its recommendation on the stock to ``hold'' from ``buy.''

Amazon.com sank $12.09, or 12 percent, to $88.73, the steepest drop since July 2006. Fourth-quarter operating income will be between $221 million and $291 million, the world's largest Internet retailer said yesterday. Scott Tilghman, an analyst at Soleil Securities Corp., estimated profit of $278.5 million.

今天的做空者会非常沮丧,这么差的业绩,如果广泛的业绩下跌,居然美股最后收盘能顽强收回来。是不是做空美股已经成为一个不可能的事情?

10月25日,市场恐慌情绪重新回到房地产和金融系统。市场广泛担心美国经济即将进入衰退。但市场形态稳定。

U.S. Stocks Decline on Credit Concern; AIG, Merrill Shares Drop

By Lynn Thomasson

``We saw renewed concerns today about the effect of the housing crisis,'' said James W. Gaul, who helps oversee about $2.2 billion as portfolio manager at Boston Advisors LLC in Boston. ``The deep, dark fear is that this is going to push us down into a recession and that the housing market is worse than anyone anticipated.''

Writedowns spurred by the worst housing slump in 16 years have caused profits at financial companies in the S&P 500 to decline 22 percent in the third quarter, the worst performance among 10 industries. Merrill yesterday posted its biggest-ever quarterly loss on charges totaling $8.4 billion and Bank of America Corp.'s profit dropped 32 percent after $2 billion in trading losses and writedowns.

Recession Concern

Stocks also fell after government reports showed an unexpected drop in durable goods orders and initial unemployment claims topped economists' forecasts, spurring concern the economy may slip into a recession. Almost two-thirds of Americans say the economy is likely to contract next year and a majority believes it is already faltering, according to a Bloomberg/Los Angeles Times survey.

10月26日股票在微软业绩超预期带动下大涨。Countrywide大涨32%,宣称可以解决自身问题。有些基金经理认为美股是全球最好的资产。

U.S. Stocks Rally on Microsoft Profit, Countrywide Forecast

By Lynn Thomasson

Oct. 26 (Bloomberg) -- U.S. stocks rallied after Microsoft Corp. and Countrywide Financial Corp. reassured investors that profits will extend five years of growth.

The Standard & Poor's 500 index posted its sixth increase in seven weeks after 65 percent of 301 members reported quarterly earnings that topped analysts' forecasts. Profits may grow 7 percent in 2007 and 12.3 percent in 2008, based on the average analyst estimate from a Bloomberg survey.

Microsoft, the world's biggest software company, climbed 9.5 percent to a six-year high after quarterly sales beat projections by more than $1 billion. Countrywide, the largest U.S. mortgage lender, had the biggest gain since at least 1982 after saying last quarter was its ``earnings trough.'' Merrill Lynch & Co. rose the most in five years on speculation its chief executive will be ousted.

``The U.S. stock market today is probably the best asset in the world,'' said Stanley Nabi, who helps oversee about $8.5 billion at Silvercrest Asset Management in New York. ``Earnings will be flat for the third quarter compared to last year. However, they're not falling off a cliff.''

这就是市场的现实。交易中永远都是这样,不同的看法相互冲突。这也是技术分析的诀窍。为什么我们不太强调对新闻进行过度解读,因为最好的解读就是市场,市场说什么就是什么。市场给出的结果是客观的,但未必是与你的判断一致的。弄清楚市场主力的想法是非常重要的。

2007年10月31日美联储降息25个基点,市场反弹到前高附近。从房屋抵押贷款问题开始为大众所知到现在已经一年多了,美股还在不断新高,市场不是永远都是正确的吗?

2007年11月1日,金融股再次引领下跌。做多股票的人看到的是机会,因为花旗的分红收益率已经达到6.88%。我们经常在市场中看到各种奇怪的观点,总体而言,很多都是只看到某个具体指标而看不到宏观趋势。

至此我们完成了第二阶段的复盘,美股的头部以及二次测试。很清楚的看到推动美股的几个宏观因子:次贷、美联储降息、美联储救助、公司盈利、公司估值等。这些因素轮番搅乱市场,一度美联储降息预期成为主流偏见,帮助股票创下新高,而二次测试头部的宏观因子同样是降息预期和次贷公司救助希望。

读者朋友们,可以借此推导2019年的美股宏观因子吗?

后续的市场发展几乎全部是围绕上述几个宏观因子展开,公司超预期的财报激发做多,次贷坏消息出来做空、美联储降息传闻鼓舞多头、对次贷相关公司救助不力打击市场。但空头总体上占据了优势,直到这个时候,市场的一些精明参与者开始意识到,次贷问题可能远比想象的复杂许多,因为银行总有提不完的计提。

U.S. Stocks Fall on Credit Concern; Citigroup, Fannie Retreat

By Elizabeth Stanton

Nov. 26 (Bloomberg) -- U.S. stocks fell, pushing the decline from this year's record highs to more than 10 percent, on concern that mounting mortgage losses will lead banks to reduce lending.

Citigroup Inc., Bank of America Corp. and JPMorgan Chase & Co., the three biggest U.S. banks, retreated after Goldman Sachs Group Inc. said HSBC Holdings Plc faces $12 billion in additional writedowns. Fannie Mae and Freddie Mac, the largest U.S. mortgage-finance companies, tumbled after UBS AG said higher credit costs will cause earnings growth to slow. Target Corp. and Macy's Inc. led retailers lower on concern consumers will spend less on holiday gifts.

``There's still a lot of fear out there because of the fact that this credit contagion is starting to widen out,'' said Larry Adam, chief investment strategist at Deutsche Bank Alex. Brown in Baltimore, which manages $58 billion. ``You're seeing increasing amounts of write-offs by banks, with some of them saying that they're going to be larger for the fourth quarter than the third.''

情绪转换的触发点还是跟联储有关。11月28日,联储官员暗示更大的降息,市场大涨,但是12月11日的议息会议,依然只降息了25个基点,市场认为这个行动太晚太小,市场暴跌。

12月21日在能源和消费超预期带动下,美股出现一波强劲反弹。这个例子再次说明,股票市场的波动总是五花八门,即便在经济周期开始走弱,公司盈利负增长的大背景下,依然有行业和公司表现突出,这会引发市场不时的波动。但是重要的技巧是:引发这些波动的原因是否是重要宏观因子,如果不是重要的因子,类似波动可以保持淡定。

12月27日,市场预期进一步的银行坏账计提,开启了整整一个月的股票下行。这个时候,我们已经可以清晰的看到,美联储已经很难提振股市,这个时候,主流偏见已经呈现出来了,经过了漫长一年多的时间。

2008年1月23日,还是降息预期提振股市。

2008年1月到5月的痛苦震荡

2008年2月5日,经济衰退的迹象进一步明显。这天引发股票大跌。但是经济衰退的阴影并没有使得股票出现持续大幅下跌,几天后,股票又恢复上涨。

2008年3月18和4月1日的大涨,同样都是源于公司盈利、联储降息和应付次贷危机的一些进展。市场的偏乐观情绪一直持续到5月19日,美股又上涨了15%。

但凡想做空美股的朋友,都应该扪心自问:在贝尔斯登破产、基本情形已经如此明朗的情况下(次贷/经济周期/公司盈利/联储降息预期),美股还能维持五个月的头部宽幅震荡,数次1~2周的快速反弹,你能应对这种挑战吗?

5月21日的大跌,来自于原油价格上涨到132,通胀预期上升,市场认为联储已经没有太多降息空间,穆迪开始调查评级过程中的错误。

随着行情进一步发展,经济周期的力量更加显性化,一个非农数据就可以击溃美股投资者信心,这些都是情绪的代表,说明多头已经处于溃败的边缘。

U.S. Stocks Plunge as Unemployment Tops Forecast, Oil Surges

By Michael Patterson

June 6 (Bloomberg) -- U.S. stocks tumbled, sparking the Dow Jones Industrial Average's worst sell-off in 15 months, after a jump in the unemployment rate and a $10-a-barrel rise in oil heightened concern the economy will sink into a recession.

`The unemployment increase is going to feed into further negatives for consumer confidence,'' said Charles Smith, who helps manage $1.2 billion as chief investment officer at Fort Pitt Capital Group in Pittsburgh. ``That's what the market's worried about.'

事后看,6月6日是一个重要的节点,打破了1月到5月的震荡行情。之后一个多月,美股持续下跌4%,直到7月16日富国银行业绩超预期,缓解了投资者担心,市场再度进入一个区间震荡市场。

2008年7月到9月的区间震荡

2008年9月份美国各种救市政策密集出笼。9月15日雷曼申请破产保护,但当天市场跌幅并不大。以下是9月份每天美国政府的救市措施。

September 2008

Main article: Global financial crisis in September 2008

o September 7: Federal takeover of Fannie Mae and Freddie Mac, which at that point owned or guaranteed about half of the U.S.'s $12 trillion mortgage market, effectively nationalizing them. This causes panic because almost every home mortgage lender and Wall Street bank relied on them to facilitate the mortgage market and investors worldwide owned $5.2 trillion of debt securities backed by them.[206][207]

o September 14: Merrill Lynch is sold to Bank of America amidst fears of a liquidity crisis and Lehman Brothers collapse[208]

o September 15: Lehman Brothers files for bankruptcy protection[209]

o September 16: Moody's and Standard and Poor's downgrade ratings on AIG's credit on concerns over continuing losses to mortgage-backed securities, sending the company into fears of insolvency.[210][211] In addition, the Reserve Primary Fund "breaks the buck" leading to a run on the money market funds. Over $140 billion is withdrawn vs. $7 billion the week prior. This leads to problems for the commercial paper market, a key source of funding for corporations, which suddenly could not get funds or had to pay much higher interest rates.[212]

o September 17: The US Federal Reserve lends $85 billion to American International Group (AIG) to avoid bankruptcy.

o September 18: Treasury Secretary Henry Paulson and Fed Chairman Ben Bernanke meet with key legislators to propose a $700 billion emergency bailout through the purchase of toxic assets. Bernanke tells them: "If we don't do this, we may not have an economy on Monday."[213]

o September 19: Paulson financial rescue plan is unveiled after a volatile week in stock and debt markets.

o September 23: The Federal Bureau of Investigation discloses that it had been investigating the possibility of fraud by mortgage financing companies Fannie Mae and Freddie Mac, Lehman Brothers, and insurer American International Group, bringing to 26 the number of corporate lenders under investigation.[214]

o September 25: Washington Mutual is seized by the Federal Deposit Insurance Corporation, and its banking assets are sold to JP MorganChase for $1.9 billion.

o September 29: Emergency Economic Stabilization Act is defeated 228-205 in the United States House of Representatives; Federal Deposit Insurance Corporation announces that Citigroup Inc. would acquire banking operations of Wachovia.[215]

o September 30: US Treasury changes tax law to allow a bank acquiring another to write off all of the acquired bank's losses for tax purposes[216]

最值得注意的就是,9月29日紧急救市法案在众议院以228-205反对通过,而民主党当时的领袖就是今天大家已经熟知的洛佩西。

标普在9月29日下跌8.8%。这是2008年美国股票市场危机最后高潮来临的时刻。接下来我们逐日复盘当时的市场反应。

图 2008年美股崩盘最后的高潮

2008年9月22日周一。上周四五期财政部美联储联合提出的经济稳定方案极大鼓励了市场,市场两天上涨了11.6%,但是周一市场大跌,下面是当天收盘后的采访。

``They really haven't changed the economic fundamentals at all,'' said Jeffrey Coons, co-director of research at Manning & Napier Advisors Inc. in Fairport, New York, which manages $18 billion. ``We still have a debt-laden U.S. consumer facing falling employment.''

``Our initial impression of the plan is that the benefits to the regional banks would be indirect, and as a result, we would lock in substantial profits generated over the past several weeks,'' wrote JPMorgan analysts led by Steven Alexopoulos.

Record Bank Plunge

回到当时的现场,政府各种救助市场的行为已经陆陆续续持续了一年,直到推出了一个完整的救市方案。但是作为交易者,心里应该明白,这个方案未必一定可以通过,因为当下要求惩罚肇事者的声音很大,第二,救市方案本身的力度是否足够。

救市方案出来后,很容易入场抄底,价量都配合。这个时候,我们要意识到,救市方案还面临很大的不确定性,应该考虑到救市失败或者市场不买账的可能性,一旦市场价格给出不对的信号,就应该及时撤离。

9月23日周二。市场继续下跌,市场依然担心7000亿的救市方案无法阻止经济进入衰退。

9月24日周三,依然困扰在救市的效力问题上。

``The concern is that this is not resolved fast enough or completely enough to restore our credit markets to health,'' said Lawrence Creatura, a fund manager at Clover Capital Management in Rochester, New York, which oversees $2.8 billion. ``If credit markets are not restored to health, the economic implications are likely to be broad and deep.''

9月25日和26日,市场盼望救市方案会被通过,小幅反弹。

9月29日周一,暴跌,救市方案被否。这可以说是对市场最致命的打击。

9月30日周二,大涨,市场相信救市方案还有回旋余地。

10月1日周三,参议院再次通过救市法案,提交众议院。市场小幅下跌。

10月2日周四,标普大跌4%,信用市场冻结的前景让市场非常恐慌。

``There's a liquidity crisis going on that's putting investors on edge,'' said Alan Gayle, the Richmond, Virginia-based senior investment strategist at Ridgeworth Investments, which oversees about $70 billion. ``Liquidity is like oxygen. Lack of it can cause serious damage in a very short time.''

10月3日周五,市场下跌1.4%。市场此刻的担心已经不是什么救市法案了,而是经济的全面崩溃。

``Once you get over one hurdle, you start looking at the next hurdle, and the next one is the weakness in the U.S.,'' said John Davidson, president of PartnerRe Asset Management in Greenwich, Connecticut, which invests more than $12 billion. ```There's doubt that we'll avoid a recession.''

这是崩盘第一周,起于救市计划被众议院否决,虽然后面不断有补救,但是市场已经陷入了恐慌,这个时候,主流偏见已经是恐慌情绪本身了。

10月6日周一,标普下跌3.9%,这已经是一个标准的金融恐慌了。格罗斯呼吁美联储下调100个基点利率,而美联储的议息会议要等到10月29日。

10月7日周二,道琼斯指数创下1937年以来最大跌幅。感兴趣的读者可以通篇读一下彭博的每日收盘评论,感受一下当时市场的恐怖氛围。GE和GM股票大跌,因为他们是商业票据的最大发行者,而市场担心他们会违约。整个流动性处于枯竭的边缘。

U.S. Stocks Drop; S&P 500, Dow Post Worst Retreats Since 1937

By Elizabeth Stanton and Eric Martin

Oct. 7 (Bloomberg) -- U.S. stocks fell, sending the Standard & Poor's 500 Index below 1,000 for the first time since 2003, on speculation banks and real-estate companies are running short of money as the credit crisis worsens.

Bank of America Corp. tumbled 26 percent after cutting its dividend in half and saying it plans to sell $10 billion in common stock to brace for a recession. Morgan Stanley, KeyCorp and JPMorgan Chase & Co. slid more than 10 percent as investors shrugged off signs the Federal Reserve will reduce interest rates. General Growth Properties Inc., a mall owner, plunged 42 percent on concern it won't be able to repay debt.

The S&P 500 slid 60.66 points, or 5.7 percent, to 996.23, extending its 2008 tumble to 32 percent in the market's worst yearly slump since 1937. The Dow Jones Industrial Average dropped 508.39, or 5.1 percent, to 9,447.11, giving it a 29 percent retreat in 2008 that would also be the worst in 71 years. The Nasdaq Composite Index lost 5.8 percent to 1,754.88.

``We've approached the edge of the cliff,'' Leon Cooperman, 65, who manages $6 billion at hedge fund Omega Advisors Inc., said at the Value Investing Congress in New York. ``Do we go over the cliff or begin to recede? History says we recede, but there's no guarantee. This is the most difficult financial environment I've lived through.''

The S&P 500 Financials Index slumped 12 percent to below its lowest level since 1997 even after Fed Chairman Ben S. Bernanke signaled he is ready to cut interest rates. The S&P 500's 15 percent retreat since Sept. 30 is the third-steepest five-day drop on record, according to Bespoke Investment Group LLC, a Harrison, New York-based research firm. The bigger slumps occurred in 1932.

`Credit Deterioration'

``The market is responding to the fact that there was credit deterioration in their businesses,'' Erick Maronak, the New York-based chief investment officer at Victory Capital Management, said of Bank of America. Victory Capital oversees $66 billion.

Merrill Lynch & Co., which is being acquired by Bank of America, sank 26 percent to $18 for the steepest decline since October 1987. JPMorgan lost 11 percent to $39.32, and KeyCorp tumbled 10 percent to $10.61.

Morgan Stanley declined as much as 40 percent on concern its sale of a stake to Japan's Mitsubishi UFJ Financial Group Inc. would fall through. The stock pared that drop, falling 25 percent to $17.65 at the close, after Morgan Stanley spokesman Mark Lane said the deal is still ``on track.''

Goldman Sachs Group Inc.'s index of stocks with high hedge fund ownership dropped 7.1 percent to the lowest level since August 2003. All 49 companies in the measure declined, giving the index a 38 percent loss for 2008.

Disney Declines

Walt Disney Co. retreated 6 percent to $26.57, the lowest price since February 2006, after Merrill Lynch downgraded the world's biggest theme-park operator to ``underperform'' from ``neutral,'' citing concern ``about the risk to earnings estimates in the current economic climate.''

General Growth Properties Inc. led an index of real-estate investment trusts in the S&P 500 to a 8.9 percent drop, sending the group to a four-year low. The mall owner at risk of not being able to refinance debt coming due this year fell 42 percent to $4.50, extending its slide over the past year to 92 percent.

Apartment Investment & Management Co., a REIT specializing in apartments, fell 27 percent to $25.50.

Tomorrow is the last day of a Securities and Exchange Commission rule banning short sales in more than 980 financial companies. Since it was announced Sept. 18, companies covered by the rule are down an average of 16 percent, according to data compiled by Bloomberg. The S&P 500 lost 17 percent during the period, while commercial banks in the gauge are down 23 percent.

GM, Ford Slump

General Motors Corp. fell 11 percent to $7.56, the lowest price since the 1950s. The automaker's European unit plans to reduce production by about 40,000 vehicles by the end of the year as credit-market turmoil causes a drop in car sales.

Ford Motor Co., the second-largest U.S. automaker after GM, tumbled 21 percent to $2.92, the lowest price since April 1983.

Advanced Micro Devices Inc., the chipmaker struggling to compete with Intel Corp., jumped 8.5 percent to $4.59 after saying Abu Dhabi will pay $700 million for a stake in a new company that will own two plants in Germany and build another in New York. The new company, which will assume $1.2 billion of AMD's debt, will receive as much as $6 billion from Abu Dhabi to expand the factories and get $1.4 billion in operating capital. Abu Dhabi will also pay $314 million to double its stake in AMD to 19 percent.

Commercial Paper Fund

Stocks opened higher after the Federal Reserve invoked emergency powers to create a special fund to buy commercial paper, which is short-term debt issued by corporations to fund operations.

American Express Co., the largest U.S. credit-card company by purchases, dropped 6.1 percent to $28.25. It had surged as much as 8.1 percent after the Fed's announcement. General Electric Co., whose businesses include jet engines, health care and television programming, added as much as 5.9 percent before closing down 5.1 percent at $20.30.

Both American Express and GE are among the biggest U.S. direct issuers of commercial paper. In the three weeks ended Oct. 1, finance-company commercial paper outstanding fell 16 percent to $683.4 billion, Fed data show.

``A connection is being made between the freeze-up in the credit markets and the drop-off in economic activity we've seen,'' said Robert Stimpson, a money manager at Oak Associates Inc. in Akron, Ohio. ``A step to loosen credit practices and allow companies to borrow again might forestall the economic weakness we've seen flow through'' to employment.

Earnings Watch

Earnings at S&P 500 companies probably dropped on average of 5.6 percent in the third quarter, according to analysts' estimates compiled by Bloomberg.

Financial companies are forecast to lead the drop in profits with a 64 percent decrease, followed by an 11 percent slide in earnings at retailers, hoteliers, restaurant chains and other so-called consumer discretionary companies.

The S&P 500 has tumbled 36 percent from its record a year ago. Based on estimated profit, the S&P 500's price-to-earnings ratio is 11.9.

``On very conservative earnings expectations for the next 12 months this market at minimum is starting to look reasonably valued,'' Leo Grohowski, chief investment officer for the wealth management unit of Bank of New York Mellon Corp., told Bloomberg Television. The unit manages $162 billion. ``Times when it feels almost irresponsible to shore up equities, they tend to be good buying opportunities historically.''

10月8日股票继续下跌。市场认为即便降息也无法避免经济衰退。

10月9日标普下跌7.6%,市场已经完全被恐慌情绪笼罩。但是有经验的交易员,这个时候应该知道,离市场的恐慌底部,可能非常接近了,随时要做好平仓的准备,甚至反手做多。

10月10日周五,市场巨幅波动,标普最低839,最高936。连续八个交易日的下跌,市场从高点计算跌掉了40%多,从崩盘前计算,下跌了34%。但是这一天并没有什么特别的救市消息。这是市场自发探寻出来的底部,这一天,标普指数的市盈率不到10倍,这一天投资者只想着如何卖出股票出逃,

10月13日周一,标普指数上涨11.6%,这是过去75年以来最大单日涨幅。这一天,同样也没有什么救市的消息,虽然明天美国版的救市计划就会正式出炉。一些经验丰富的投资者说,最坏的时候已经过去了。

``The worst of the immediate danger is past,'' said Bruce McCain, chief investment strategist at Key Private Bank in Cleveland, which manages $30 billion. ``It's always easier when you've got markets going up and you're not having to talk clients back in off the ledge.''

毫不夸张的说,这是炼狱般的八天,也会被永久记入美国股票史。

相似的历史

作为一个交易员,花这么多时间详尽复盘2008年的美股崩盘历程,显然不是为了研究的需要。通过复盘1929/1987/2001/2008 美国四次股灾级别的市场,我是为了更好的理解和规划2019或者2020年美股类似的一次下跌。

简单看,从过程上看,未来美股的崩盘更加接近2008年,会是一个非常复杂动荡难捱的过程,远不是一句做空就可以形容的。

扫码下载智通APP

扫码下载智通APP